Turkish Citizenship by Investment Program

Turkish Citizenship for Pakistani

was firstly launched in early 2017 to attract foreign investors to boost the country’s economy in the real estate sector. Investors had to invest a huge amount to secure their Turkish citizenship. Later on, the Turkish Government has significantly eased in minimum investment requirements from September 2018.

Turkish Citizenship for Pakistani investors is a great career-driven option for a bright future. All Pakistani are eligible for Turkey’s second passport by investing a certain amount in Turkey.

If you are interested in Turkish Citizenship by Investment in Property but unsure about the available options, this most up-to-date information will help you in how to get turkish citizenship by investment.

Investment Options

By the new regulation, investors can choose a variety of investment options for getting Turkish citizenship by investment along with the immediate family members.

Option 1: Investment in Real Estate with the minimum US $250,000

Investors can buy one or multiple residential, commercial properties by investing at least US $250,000 confirmed by the Ministry of Environment and Urbanism and can get rental incomes on those properties. However, it will have to hold for the next three years to meet the citizenship requirements. Before September 2018, the minimum requirement for investing in this option was 1 Million Dollars (US $1,000,000).

Option 2: Cash Investment with the minimum US $500,000

Investors can also invest in fixed assets confirmed by the Ministry of Industry and Technology, Turkey with a minimum of US $500,000 deposit in any Turkish Government bank for the next three years. Government bonds with the potential to receive interest as income. Before September 2018, the minimum requirement for investing in this option was 2 Million Dollars (US $2,000,000).

Option 3: A Company Set-up with a minimum of 50 Turkish employees

Investors have also an option to set up a business and create jobs for at least 50 Turkish citizens Option to set up a business and create jobs for at least 50 Turkish employees, approved by the Ministry of Labor and Social Security. Before September 2018, the minimum requirement for creating the jobs in this option was 100 Turkish employees. In the above options, the most cost-effective option for investors is to purchase the immovable property in Turkey with a minimum value of US $250,000 for the qualifying in the Turkish citizenship program.

Turkish Citizenship by Investment Requirements

Investment Requirements

Scope and amounts determined as per the new regulations published in the Official Gazette on September 18, 2018 are defined below. Foreigners who meet any of the following criteria may be eligible for Turkish citizenship, subject to the decision of the President of the Republic of Turkey:

- Made a minimum fixed capital investment of US $500,000 or equivalent foreign currency or Turkish lira, as attested by the Ministry of Industry and Technology.

- Acquired a property worth a minimum of US $250,000 or equivalent foreign currency or Turkish lira with a title deed restriction on its resale for at least three years, as attested by the Ministry of Environment and Urbanization.

- Created jobs for at least 50 peoples, as attested by the Ministry of Family, Labor and Social Services.

- Deposited at least US $500,000 or equivalent foreign currency or Turkish lira in banks operating in Turkey with the condition not to withdraw the same for at least three years, as attested by the Banking Regulation and Supervision Agency.

- Bought at least US $500,000 or equivalent foreign currency or Turkish lira worth of government bonds with the condition that they cannot be sold for at least three years, as attested by the Ministry of Treasury and Finance.

- Bought at least US $500,000 or equivalent foreign currency or Turkish lira worth of real estate investment fund share or venture capital investment fund share with the condition that they cannot be sold for at least three years, as attested by the Capital Markets Board of Turkey

General Requirements

- Not having entered or stayed illegally in Turkey

- Be at least 18 years old

- No criminal record in Turkey, or in any country the investor has resided in over the past 10 years

- Not selling the property for at least 3 years

Turkish Citizenship Benefits

- You would not be required to stay in Turkey for a minimum amount of days

- Fast citizenship application processing within 90 days of application

- You, Your spouse, and all children under 18 years of age automatically qualify under your citizenship application

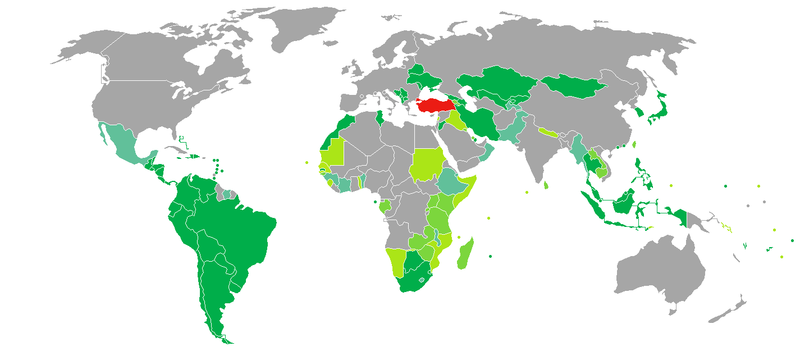

- Visa-free or on arrival access to 115 countries including Malaysia, Singapore, Japan, South Korea, South Africa and the majority of South American countries

- Reside in the USA through the USA E-2 Investor Visa through US E-2 Treaty Program

- Relocate to the UK under the Ankara Agreement, allowing Turkish nationals to set up business in the UK and relocate within as little as one month

- For entry into Europe, Turkish nationals enjoy a privileged status, making it very easy for them to obtain Schengen visas. In addition, there is an agreement with Greece that allows Turkish citizens to visit for short holidays, without being required to obtain a Schengen visa.

- Easy visa access to Europe, Canada and Australia

- Rental income and option to re-sell the property in 3 years

- Free education for children & Healthcare for all family

- Significant tax advantages and the ability to protect your assets

- Enjoy a mild Mediterranean climate, beautiful scenery, and a high standard of living

- No wealth declaration required

- Dual Citizenship allowed legally

- Most developed Muslim country offering a democratic and safe environment for families of all religious

- The only country that provides citizenship without a residency condition.

Turkish Citizenship by Investment Process

1. Talk to Our Advisers

Our advisers provide a one-stop solution and hassle-free service to investors seeking to acquire Turkish citizenship by investment from the purchasing stage to getting a Turkish passport. We guide you through every step of the Turkish citizenship acquisition procedure with due diligence and care, ensuring that your application is submitted correctly and followed up to application approval. They evaluate your personal circumstances and help you in selecting the most suitable investment option.

2. Choose the best property option

Either the investor chooses the residential or commercial property, we help them to carry out all the legal procedures in Turkey under government guarantee. We determine the best investment opportunities that match your criteria and offer you various property options including report physical features, legal status, price and profitability ratio, etc.

3. Purchasing the property

Once the investor is ready to make the deal and seller accepts the offer, we carry out all legal formalities including transfer procedure, ensure that property is ready to live, free of any debts, taxes and environmental charges, land registry, sale contract and finally get the title deed of the purchased property on the behalf of the investors. In this step, the investor also makes a transaction of the decided amount into a seller account and we help in getting tax numbers.

4. Apply for the residence permit

After successfully getting the title deed, we apply the residence permit of the main applicant only as there is a requirement of applying for Turkish citizenship that the main applicant must hold a valid residence permit.

5. Apply for Turkish Citizenship

Once the residence permit is granted then we share a detailed list of documents with the investors and guide them to obtain every single document. All shared documents always check thoroughly according to the requirements.

6. Receive a Turkish Passport

Within 60 days of applying, you and your family become Turkish citizens and enjoy all the benefits that come with Turkish Citizenship. As a naturalized Turkish citizen, an investor seeking to set up a business in the UK or USA has enhanced opportunities to do so, and is able to consider relocation alongside their entire family.

Turkish Citizenship Application Fee

Application Fee – $400

Turkish Citizenship Processing Time

The current processing time of Turkish Citizenship by investment is 90 days after getting a Residence Permit card.

Turkey Citizenship by Investment official website

Turkey Passport visa-free countries

The power and strength of the passport of any country determined by the Henley Passport Index and The Passport Index. They rate the countries’ passports by mentioning the number of allowing countries either on arrival or visa-free. Turkish passport has the 39th rank of strongest passport in the world according to 2019 evaluations.

The Turkish passport has a number of benefits but the most attractive benefit is to free visa access or on arrival around 115 countries including 71 visa-free while 44 on-arrival visa countries access. Below is the complete list of accessible countries region-wise.

Americas

Argentina, Bahamas, Belize, Bolivia, Brazil, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Colombia, Costa Rica, Mexico, Nicaragua, Panama, Paraguay, Peru, Chile, Uruguay, Venezuela, Antigua and Barbuda, Barbados, Dominica, Saint Kitts (Saint Christopher and Nevis Islands), Saint Lucia, St. Vincent and Grenadines, Trinidad and Tobago, Turks and Caicos Islands, British Virgin Islands, Jamaica & Suriname.

Africa

Botswana, Morocco, Ivory Coast, Gambia, South Africa, Kenya, Comoros, Libya, Madagascar, Mauritius, Mozambique, Rwanda, Senegal, Seychelles, Tanzania, Togo, Tunisia, Zambia, Zimbabwe, Sudan, Djibouti, São Tomé ve Príncipe, Sierra Leone, Eswatini & Uganda.

Europe

Andorra, Albania, Azerbaijan, Belarus, Bosnia and Herzegovina, Montenegro, North Cyprus (KKTC), Kosovo, North Macedonia, Moldova, Serbia, Ukraine, Georgia, Russia, San Marino, Monaco & Vatican.

Asia

Bahrain, East Timor, Indonesia, Armenia, Philippines, Palestine, South Korea, Hong Kong, Japan, Iraq, Iran, Cambodia, Qatar, Kazakhstan, Kyrgyzstan, Kuwait, Lebanon, Macao, Maldives, Malaysia, Myanmar, Mongolia, Nepal, Singapore, Sri Lanka, Thailand, Taiwan, Oman, Tajikistan, Jordan, Syria, Bhutan, UAE (Online), Pakistan (Online) & Brunei.

Oceania

Cook Islands, Fiji, Niue, Palau, Tonga, Tuvalu, Republic of Vanuatu, Samoa & Solomon Islands.

Why Invest in Turkey?

Strategic Location

Turkey is conveniently located at the intersection of Europe and Asia. 1.5 billion people and $24T GDP in Europe, MENA and Central Asia at 4-hour flight-distance. Turkish Airlines connects you to 255 destinations in 122 countries. Manufacturing & Export hub for multinationals as well as a management hub for multinationals. The convenient location has enabled Turkey to tap significant export opportunities with increasing diversified markets and products.

Robust Economy

Turkey is the 13th largest economy in the world and one of the fastest-growing economies among OECD members. The average annual GDP grew up to 5.6% from 2003 to 2018.

Domestic Market

Turkey’s economic growth has paved the way for the emergence of a sizeable middle-class with an increasing purchasing power. The income per capita has raised up to US $27,956 till 2018. The domestic market is further supported by emerging 24 urban centers across turkey. Customs Union with Europe allows direct access to the EU Market

Skilled Workforce with the cost advantage

Turkey’s Education System has been upgraded to support a skilled labor pool that meets business requirements. The annual number of graduates from university approx. 846,000 while graduates from vocational and technical high school approx. 495,000. Labor cost per hour in manufacturing is quite low in comparison with France, USA, UK, Germany, Hungry, Polland and many other manufacturing countries.

Major Reforms

Turkey has implemented sweeping reforms in many areas and continues to introduce new reforms. It takes only 7 days to set up a company.

Business-friendly

Turkey offers protection and ease of doing business by Foreign Direct Investment Law, Bilateral Investment Protection Treaties with 75 countries, Treaties to avoid Double Taxation with 80 countries.

Lucrative Incentives

Investors are offered lucrative incentives in many ways like manufacturing incentive with a tax deduction and exemption; employment incentives with payroll and training support; R&D Innovation with a tax deduction and exemption; Service exporters with a tax deduction for exporting services in engineering, accounting, design, software, medical reporting, call center, data center, education & healthcare; technology development zones with support R&D and tax exemption; exclusive zones with free zones from tax exemption & organized industrial zones with developed infrastructure.

Resilient Healthcare System

State hospitals, social security hospitals, and institutional hospitals were merged for use by all citizens. With their modern infrastructure, high-tech devices, and qualified healthcare professionals, 12 city hospitals entered into service in 11 provinces while 10 more city hospitals are under construction. 1,526 hospitals, some 4,000 medical treatment facilities, and over 15,000 primary healthcare centers continue to provide healthcare services without any disruption. State-of-the-art technology ambulance fleets were formed with 5,400 fully-equipped vehicles and 19 aircraft. The budget set aside for healthcare services was increased from 19 billion TRY to 190 billion TRY over the past 17 years. Healthcare expenditures during the past 6 years have grown by 14%.

Opportunities

In the Automotive sector, Turkey is the 15th largest manufacturer produced 1.5 million vehicles, the market is $24 billion and export is $ 31.2 billion. In machinery & electrical equipment, Turkey is the largest TV & white goods producer in Europe, the market is $38 billion and export is $25 billion. In Aerospace & Defence, Turkey is spending $19 billion, Industry is $9.7 billion, export is $2.2 billion & air passengers are 210 million. In the Energy sector, Turkey is growing its demand in the energy corridor and untapped renewable. In Argofood, Turkey exports to around 200 countries, the market is $90 billion and export is $17 billion. In Infrastructure, more opportunities in transport, energy, and health and having $127 billion PPP contracts from 2003 – 2018. In Finance, robust growth with double digits and Islamic finance is growing.

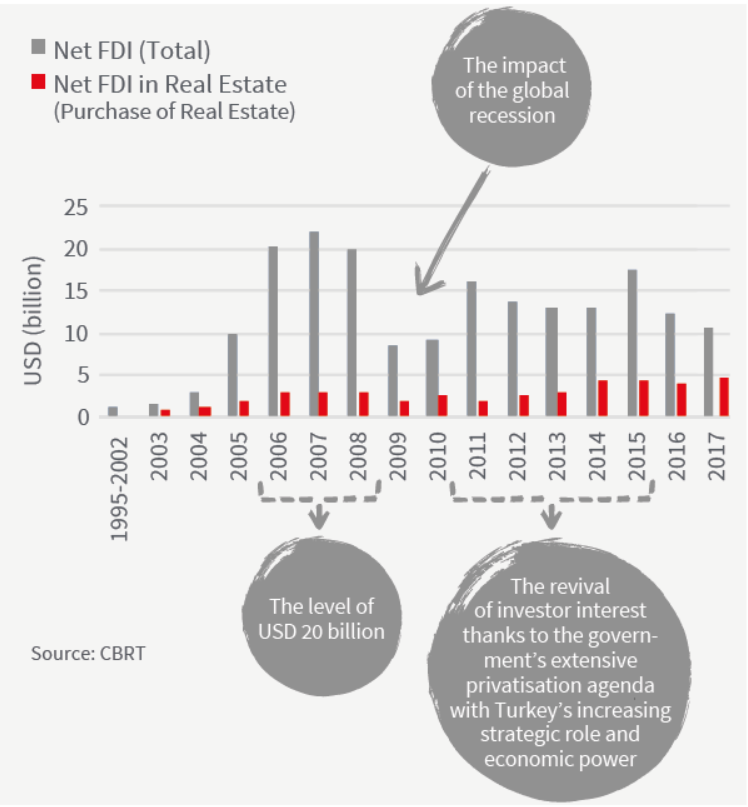

Foreign Direct Investment (FDI)

Turkey’s value has been appreciated by foreign investors with increasing FDI inflow to turkey. 74,200 Foreign Companies in Turkey, in which 33.4% of finance, 24.4% of manufacturing, 11.3% of energy, 7.7% of information & communication services, 6.6% of wholesale & retail trade, 4.7% of transport & storage, 3.3% of construction while 8.5% of other most attractive sectors of investors. The macro-economic and political stability that has been evident since 2002 has had a positive impact on foreign investment inflows into Turkey. Turkey attracted USD 130 billion of foreign direct investment (FDI) over the last ten years. Part of this can be attributed to the adoption of the EU reform agenda, which includes the reduction in red tape bureaucracy concerning company establishment, a reduction in corporate tax rates from 30% to 20%, and liberalization of the investment environment, enabling foreign companies to be subject to equal rights and conditions as Turkish companies. The educated labor force of Turkey, with lower wage levels than Europe, adds to the country’s attractiveness as an investment destination.

Why SPARK Consulting

Professional Advisers

We at SPARK have a team of professional experienced advisers, those help to all clients in getting the citizenship.

Investment and Real Estate Consultancy

We help to decide in making the investment that fits your expectations, purpose, and budget. We provide agency services to find the ideal property for the investors. The agency services can also include open a bank account in a Turkish bank, property valuation report, getting title deed, review the assessment report of the real estate, drafting and execution of the sale agreement, land registry procedures, etc.

Legal Consultancy

Legal assistance is necessary to get things done in a proper and legitimate way. Our lawyers help the investors in contractual arrangements for the related investment, obtaining tax ID number, preparation, and submission of Residence Permit Application, assistance in citizenship by investment application both for the investor and for all family members

Maintain Confidentiality

We maintain the confidentiality of all the provided information by the investors. It doesn’t share with any irrelevant persons.

Sincere advice and transparent process

We always believe in giving a sincere & honest opinion to all investors and guide them according to ongoing legislation. We share a clear and transparent track record on investors’ applications.

Turkey Citizenship by Investment Real Estate

Looking at retail investment in terms of commercial real estate, Turkey ranked as the 9th most traded market in Continental Europe in 2006/2007. This indicated the scope of investor interest in the market, which was driven by strong demographic features, growth prospects, the quality of shopping center supply, and retailer demand.

Starting from 2003, the investment climate began to improve due to the “Foreign Direct Investment Law” passed by the Parliament. Article 3/d allowed foreign investors to acquire real estate assets without any limitation.

However, Turkey experienced some political and legal changes in 2008, such as the annulment of the regulation by the Supreme Court that enabled foreigners to acquire assets in Turkey. This caused uncertainty in the market and investor appetite decreased. The issue was corrected when the new regulation concerning the Acquisition of Real Estate and Limited Rights in Rem by Companies with Foreign Capital was put into effect in October 2010. The new regulation reduced limitations on foreign investment in real estate and caused the investor appetite to come back. This was supported by further legislation improvements over time, increasing investor confidence in Turkey. When the Reciprocity Law took effect in 2012, real estate acquisitions by foreign investors almost doubled.

The attractiveness of the Turkish real estate market has increased since the 2000s. Initially, this was mostly in the form of individual investors buying residential property in Turkey. Since 2005, we have seen a number of foreign real estate investors entering the Turkish market. Redevco (the complete portfolio of which was acquired by Blackstone in July 2012), Multi Development (the complete portfolio of which was acquired by Blackstone in July 2013), and Corio (acquired by Klepierre in 2014) have heavily invested in the Turkish retail market.

The Government of Singapore Investment Corporation (GIC) first acquired a 50% share of three shopping centers and became partners with Rönesans. GIC then acquired close to a 20% share of Rönesans Real Estate. In addition to sovereign wealth funds, the market witnessed business development activities of foreign property companies such as Amstar Global Partners (APG).

Despite the economic revival in 2010, the investment market remained relatively inactive, except for a few transactions. These included the acquisition of the remaining 35% of Forum Mersin by Union Investment at EUR 68 million from Multi (Union purchased 65% in 2006) and the acquisition by Dutch fund Vastned of two historical buildings on Istiklal Street in Istanbul for EUR 18 million and EUR 29.5 million.

The market gained liquidity in 2012 with the acquisition of the Redevco portfolio by Blackstone, consisting mainly of shopping centers in Ankara and in secondary cities such as Erzurum and Manisa. This was the first strong indication of global investor interest in Turkey.

The transaction had a ticket size of approximately EUR 220 million, indicating a blended yield of around 9%. Blackstone expanded its portfolio by acquiring the European shopping center portfolio of Multi Development. Turkish assets made up the largest part of that portfolio and included Forum Marmara and Forum Istanbul, two super-regional shopping centers in Istanbul, and 6 other centers as well as some projects in the pipeline across the country. The transaction was in the form of acquisition by Blackstone of the debt within Multi Development. These transactions overall provided good evidence for yield levels of non-prime assets in major cities, while the Blackstone transaction provided evidence for yield levels in secondary cities.

Blackstone’s transaction in 2012 was followed by GIC’s acquisition of 50% of Optimum Istanbul and Optimum Ankara, both of which are owned by Rönesans Group, one of the major retail developers in Turkey. The yield level in these transactions was slightly less than 8% for the Istanbul asset and greater than 8% for the Ankara asset.

In the office market, major transactions were the acquisition of Kristal Tower in 2013 by Finansbank at an estimated price of EUR 230 million, the acquisition of LEED Platinum-certified Ronesans Tower in 2015 by Allianz for EUR 170 million, and the acquisition of a 19,000 sq m office block in the mixed-use project in 2015 by the Azerbaijan oil company SOCAR, which invested USD 63.5 million with the intention of moving its new HQ office to Seyrantepe upon completion of the project.

Turkish Citizenship by Investment Law for buying a property in Turkey

1. Legal Structure

a. Abolishment of Reciprocity Law in 2012

In accordance with Article 35 of the Land Registry Law No. 2644, which is in effect in the country since 1934, and amended by Law No. 6302 on 18 May 2012, the condition of reciprocity for foreigners who wish to buy real property in Turkey was abolished in line with EU principles. With this important amendment on the article of Land Registry Law, regulation of the acquisition of real properties and rights in rem in Turkey by foreign real persons and legal persons was rearranged to attract the foreign capital and to boost the influx of foreign direct investments into the Turkish economy.

At this point, persons with foreign nationality can buy any kind of property (house, business place, land, and field) within the legal restrictions. Persons with foreign nationality who buy property without construction (land, field) also have to submit the project that they will construct on the property to the relevant Ministry within 2 years.

According to the Turkish laws and regulations in force, transfer of ownership of a property is only possible with an official deed and registry that is signed at the Land Registry Directorates. It is possible to sign a “sales commitment agreement” before a notary; however, legal ownership to the property does not pass with a “sales commitment agreement” or another kind of sales agreements signed before the notary.

b. Acquisition by non-Turkish Nationals

i. Legal Structure for Foreign Real Persons:

There are some points to be noticed by foreigners who wish to buy property in Turkey.

- The foreigner has to inquire with the Land Registry Directorate if there is any limitation on the property, such as a mortgage, arrestment, or any obstacle which prevents the sale of the property.

- If the application by the foreigner for buying a property is rejected, the act can be appealed to the relevant Regional Office of the Land Registry Directorate.

- It is advised that foreigners should work with persons/companies who/which are expert and reliable.

- Having a residence permit is not a condition for the foreigner who wishes to buy a property in Turkey. Likewise, buying a property does not automatically grant the foreigner a residence permit in Turkey.

- If there is a disagreement between the sides on the sale of the property, the case has to be brought before the Turkish courts by referring to judicial authorities.

A number of legal restrictions for foreigners in buying property are also considerable points to be emphasized.

- Persons with foreign nationality can buy a maximum of 30 hectares of property in Turkey in total and can acquire limited in rem right.

- Foreigners cannot acquire or rent property within military forbidden zones and security zones.

- Persons with foreign nationality can acquire property or limited in rem right in a district/town up to 10 % of the total area of the said district/town.

- Legal restrictions do not apply in setting mortgages for real persons and commercial companies having legal personality that are established in foreign countries.

- The properties are subject to winding up provisions in the following cases:

If the properties are acquired in violation of laws

If the relevant ministries and administrations identify that the properties are used in violation of the purpose of purchase

If the foreigner does not apply to the relevant ministry within time in case the property is acquired with a project commitment

If the projects are not materialized within time

ii. Legal Structure for Foreign Legal Persons:

a) Acquisitions by Foreign Companies

- Acquisition of property by companies that are registered in Turkey is governed by Article 35 of the Land Registry Law No 2644.

- Foreign commercial corporations that are established according to the relevant laws of their countries of origin, can acquire property and limited in rem rights within the provisions of special laws.

- These special laws are Petroleum Law No. 6326, Law on Encouragement of Tourism No. 2634 & Law on Industrial Zones No. 4737

- No restriction is implemented in favor of the said commercial companies in establishing a mortgage.

- Other foreign corporations (i.e. foundation, association) cannot buy property nor acquire limited in rem right.

b) Acquisitions by Companies with Foreign Capital

The companies with foreign capital,

- If the foreign investors hold, individually or collectively, 50 % or more shares of the said company,

- If the foreign investors do not hold any share of the said company but have a right to assign or remove the managers of the said companies on the condition that the said company has a legal personality in Turkey,

- They could buy property in Turkey in accordance with Article 36 of Land Registry Law No. 2644 and the “Decree on Acquisition of Property and Limited in Rem Rights by Companies and Corporations within the Context of Article 36 of Land Registry Law No. 2644”, dated 16.08.2012.

- The Land Registry General Directorate has published a circular No. 2012/13 (1735) on “acquisition of property and limited in rem rights by companies with foreign capitals”

2. Taxation on Acquisition, Utilization, and Sales of a Property

Acquiring, holding, and selling property in Turkey is subject to a number of taxes, duties, and charges.

a. Acquisition

- The declared purchase price cannot be lower than the registered value of the property determined by the relevant municipality.

- Title Deed Fee: 2% over the sales price for buyer and seller separately.

- Value Added Tax (VAT): Applicable to all property sales including office, residential properties, and land acquisitions. It is 18% and calculated over the sales price. Specific VAT rates such as 1% and 8% are also applicable for residential units with less than 150 sq m net area. (Not applicable for the seller/owner of the property, which is an individual (not dealing with any commercial activity) or a company (not dealing with real estate trading on a regular basis and holding the said property for more than two years)).

- Stamp Tax: Applicable over the highest monetary value stated or referred in the agreement at 0.948%. (Not applicable for a transaction between individuals who are not dealing with any commercial activity.

b. Utilization & Leasing

- Property Tax: Various rates – according to property type and location – calculated by municipalities.

- Surcharge for the Protection of Immovable Cultural Assets: Collected together with the property tax at 10% of the annually collected property tax.

- Compulsory Earthquake Insurance (DASK): A compulsory insurance – according to the Law on Natural Disaster Insurance – for the land registry and utility services such as electricity, water, and sewage system connection).

- For the subscription of utility services, the new owner or tenant of the property has to apply relevant institutions and execute and utilization agreement.

- Leasing Property

- Rental Income Tax: Applicable to gross rental income throughout the calendar year, and stands between 15% and 35% (gradually increasing according to the total income).

- Withholding Tax: Applicable to landlord whose gross rental income exceeds TRY 30,000 in 2016.

c. Sales

- Capital Gain: Property Tax: Applicable to the positive difference between the sales price and the cost of the property (incl. the acquisition value, expenses incurred due to disposal and remain under the responsibility of the seller, and taxes and charges paid)

- Value Added Tax (VAT): 18% and calculated over the sales price. Specific VAT rates such as 1% and 8% are also applicable for residential units with less than 150 sq m net area. (Please see ‘acquisition’ for further details)

3. Ownership Models for Developers

a. Single Ownership Model

- Land acquisition is the major issue for this practice due to high land costs and lack of land availability in the city center

- The developer covers all costs single-handedly, thus it could lead to some financial bottleneck in the development process.

- It offers the highest yield during disposal transactions thanks to property rights, which are held 100% by owner.

b. Flat for Land Model

- The common practice in the office and residential market.

- The title deed of the estate, which is the final product of the process, is shared between developers and landowners in terms of independent units.

- It has a negative effect on the office buildings, impairing the quality because of strata sale transactions, particularly in the disposal process.

c. Revenue Sharing Model

- The most preferred development model especially in the retail market.

- In general, the model is put into practice by a joint venture between landlords and developers.

- Like the flat for the land model, this practice offers a low yield rate during the disposal process.

Frequently Asked Questions

Is a residence permit required for property acquisition by foreign real persons?

Article 35 of the Land Registry Law No. 2644, amended with the Law No. 6302, specifies that “Provided that legal restrictions are complied with, foreign origin real persons who want to become citizens of the country as defined by the President were required for international bilateral relations and interests of the country may acquire property and limited real rights in Turkey. Real persons who are citizens of a country in the list of specified countries are not required to obtain a separate residence permit to acquire property and limited real rights.

What are the restrictions for property acquisition by foreigners?

First of all, the country of the foreigner desirous of acquiring a property must be among the countries cleared by Turkey for property acquisition as specified in Article 35.

Property acquisition by foreign real persons is only possible within the scope of legal restrictions further to Article 35 of the Land Registry Law 2644.

Foreigners may not acquire properties in military forbidden zones further to the Military Forbidden Zones and Security Zones Law No. 2565.

A foreign real person may acquire properties and restricted real rights of up to 30 hectares maximum. The President may increase this size up to two times.

The total area of properties acquired by foreign real persons and independent and continuous limited real rights may not exceed ten percent (10%) of the surface area of the subject district of the private property.

Acquisition by foreigners is not possible at the places included in strategic areas and special security zones defined by the President as areas where foreign real and legal persons may not acquire properties.

Are there any liabilities required on the part of a foreigner who acquires a land without any building?

Any foreigner who acquires a land without any building is required to develop a project on the acquired land within 2 years from the date of acquisition, and submit the project for the approval of the related ministry depending on the type of the project. The time frame for completing the project shall be determined by the relevant ministry.

Who would be eligible to receive Turkish citizenship under my application?

It is possible to obtain Turkish Citizenship and Passport for yourself, as well as for your family members including your wife and children below 18 years old (18 years old included) with proceeding one of the above-mentioned investment options according to your choice, and once the required conditions are duly met.

What will be the possible documents required for Turkish Citizenship?

Each applicant needs to provide some legal documents to Turkish Government Authorities, for verification and validation purposes. Those documents can collect easily in a week’s time from your Legal Embassy or Interior Ministry. We will share the List of Needed Documents when you decided to start the process with us. On different nationalities, documents can be changeable

What is your service fee and how is the payment structure working?

Our service fee is chancing on which method you like to use for the application. If you chose to move with Bank Cash Investment, all procedures done by banks and you send cash investment directly to the bank. We charge our service fee with a legal invoice afterward from your side.

How can I find a suitable property to buy for $250.000 valuation at least?

For property investments, we have a detailed portfolio including all types of houses and landlines in key cities of Turkey, in which we all did legal and governmental expert valuations set. If you chose to work one of our portfolio assets, you do not need to worry about that process which is a blocker for many cases.

What are the tax implications for me?

Turkey has signed double taxation with most nations in the developed world. If you have already paid the relevant taxes on income earned outside of Turkey, then you are unlikely to be taxed again by the Turkish government, even if it was earned in a country that has not signed a double taxation treaty with Turkey. If you have more queries relating to the Turkish tax structure, then we advise you to speak to a Turkish tax specialist.

Would I be required to declare my wealth to the Turkish authorities?

No. The Turkish tax authorities will not ask you any questions about your financial status, or existing assets.

Will my Turkish citizenship expire at any time in the future?

No. Once you have held onto your investment for the minimum period of 3 years, you will become a Turkish citizen for life, as will your spouse and children.